Annual dose of empirical data shows nuclear power in continued decline

By Linda Pentz Gunter

When arguing the case for or against nuclear energy, you can go with the masters of spin and omission or you can go with the empirical data. We prefer the latter. And for that, there is the welcome annual edition of the World Nuclear Industry Status Report.

After that, the job becomes easy. There IS no case for nuclear power. It’s fundamentally over. Yet governments — mainly those of nuclear weapons states — cling on to it even as their fingers are loosened one at a time from the ledge. They refuse to fall. Why?

These questions are largely answered in the 2018 edition of the WNISR which rolled out in London, UK on September 4, and is available for download — in full or as an executive summary — from the WNISR website. (The US rollout is October 9 in Washington, DC.)

The report each year contains a roadmap trajectory of the nuclear power industry’s fate worldwide. For some time now, that trajectory has pointed downwards. There may be the occasional slight bump upwards (mostly due to China) or plateau, but fundamentally over the long haul, nuclear power is in decline.

This year is no different. China remains the only skewer of statistics, but even this is easy to misread. Yes, China did start up three new reactors each in 2017 and in the first half of 2018. It has dominated the nuclear power scene over the last 10 years. But it has not started any new commercial reactor construction projects since 2016. Meanwhile, wind energy generates more electricity in China than nuclear power, and solar energy is fast catching up there. And once you take China out of the statistics, the global picture darkens dramatically, revealing a decrease in global electricity generation for the third straight year. Even with China back in the balance, the increase is only by 1%. The nuclear share in the global power mix has been declining since 1996.

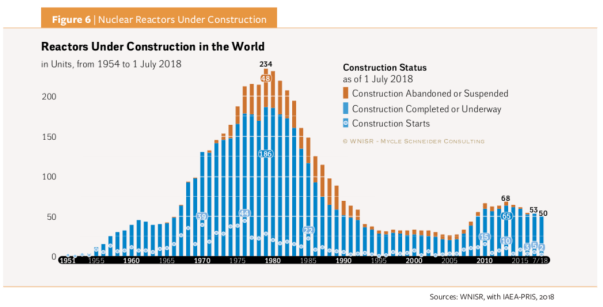

In fact, nuclear construction starts are in steep decline worldwide. Fifteen new reactor projects were begun in 2010 but only two in the first half of 2018. Half of the new projects begun in 2007 are still under construction. The average time to completion remains 10 years but some take far longer — Iran’s Bushehr reactor for example, took 36 years. Watts Bar-2 in the US took 43! The global nuclear industry might try to generate excitement by trumpeting five new reactor startups in the first half of 2018. But aside from those three in China, the other two were Russian and one — Rostov-4 — took 35 years from start to finish.

This means that predicted startup dates for new projects are invariably wrong. Delays are the norm, and more than half of reactors still under construction are seeing their delay times lengthen. There were supposed to be 16 new reactors coming on line at the start of 2017, but only four started up.

There are 413 reactors still operating in the world in 31 countries — almost 50% of them in the USA and France. Operating, in this case, means actually generating electricity. If a reactor has not done so for 18 months in a row, the WNISR considers it in “Long-Term Outage” or LTO. (The IAEA, it should be noted, considers idled reactors “operating” which misleadingly inflates the numbers as many never restart.)

But if bringing a new reactor on line is a long, slow process, so, too is decommissioning the closed ones. And that, say the WNISR authors, is where the future of nuclear lies. If the nuclear power industry wants to maintain its reputation as “big business” it should put all its energies into decommissioning. It is, says WNISR co-author, Antony Froggatt, a $1 trillion market.

“There is a huge need for engineers,” Froggatt says. “And there is a huge growth in the decommissioning market.” With 173 reactors closed down in the world so far, 115 of them are in various stages of decommissioning. To date, only 10 have actually arrived at the greenfield site phase. This may be where the money is, but, more important is where the decommissioning funds actually are. Some are held by governments and others are in private funds. The funds, of course, must be available when it is time to decommission. (As we have noted at Beyond Nuclear in the past, in relation to decommissioning funds for the now closed Vermont Yankee, fluctuations in the stock market can put such invested funds in jeopardy.)

All this begs the question as to why the nuclear industry and the governments that support it, insist on persisting? Nuclear power is no longer economical, and, as WNISR co-author, Andy Stirling of Sussex University, pointed out, “it’s normal that technology becomes obsolete.” But, as he added, despite such evident obsolescence, we are faced with this “odd persistence of nuclear power.”

His thesis, co-written with Sussex University research fellow, Phil Johnstone, contends that the “persistence” is not about electricity at all, but nuclear weapons systems. Most of the countries that commit to large scale nuclear build are the nuclear weapons states. Nuclear submarines are very difficult to build and require nuclear propulsion know-how that can be furnished by those who worked in the civil reactor sector. And of course, strategic nuclear weapons are viewed as a credential to sit at the UN Security Council table. This claim of interdependence between the civil and military nuclear sectors has become a new driver — among several — to justify new nuclear construction and continued operation of existing reactors.

Stirling and Johnstone poured through documents and discovered commentaries in the UK military nuclear sector — but not in the civil sector — that the new civil nuclear power plant underway at Hinkley C was essential for the military sector. It was described as having “unqualified strategic benefits,” while carefully not mentioning what these actually are.

This and other findings bolster the claim that continuity in the civil nuclear sector is essential, but only to provide the know-how, technology and personnel to expand and upgrade the nuclear submarine sector. In other words, Trident.

“In several countries, it may be that military drivers play a significant role in the persistence of what is otherwise increasingly recognized to be the growing obsolescence of nuclear power as a low-carbon electricity generating technology,” the authors concluded.

The WNISR is rich with graphs and useful statistics that compare the performance of nuclear power with renewable energy. There are sections on seven focus countries — China, France, Germany, Japan, South Korea, the United Kingdom, and the United States — and a look at “newcomer” countries and the likelihood of planned nuclear power programs reaching fruition there.

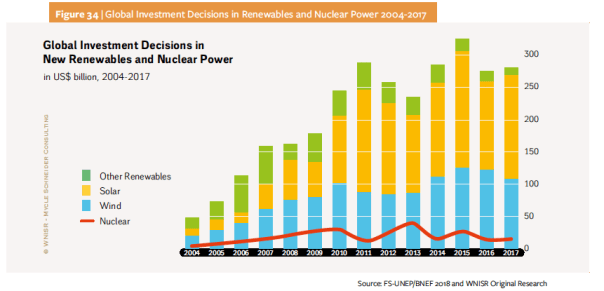

At the end of the day, nuclear power only contributes 10.3% of the world’s electricity. In nuclear “poster child” China, it is even less at 3.9%. Renewables, meanwhile, continue to outshine nuclear. As the report finds, “Globally, wind power output grew by 17% in 2017, solar by 35%.” Even the nuclear power club saw renewables do better. “Nine of the 31 nuclear countries—Brazil, China, Germany, India, Japan, Mexico, Netherlands, Spain and United Kingdom (U.K.)—generated more electricity in 2017 from non-hydro renewables than from nuclear power.”

The curtain is falling on nuclear power. The only questions remaining are how long politicians will prop it up with subsidies and how strongly defense departments will argue that abandoning civil nuclear energy impacts national security.

If you’d like to be the first to read stories like these, sign up for our Monday email digest. We will send you a very brief synopsis of the new stories on our site, with links to read them and learn more. Sign up today!

Beyond Nuclear International

Beyond Nuclear International

Pingback: Report tracks global success of renewable energy — Beyond Nuclear International « Antinuclear